AI Fraud Detection Engine

Detect Fraud Before It Happens With Real-Time Intelligence

Score, flag, and prevent high-risk transactions with behavior models

See AI Fraud Detection Engine In Action

The AI Fraud Detection Engine by Kriatix is a low-code, AI-powered platform that helps you monitor, detect, and prevent fraudulent activities across financial transactions, insurance claims, user behavior, and digital systems. Whether you’re in fintech, e-commerce, banking, or insurance, this engine brings security, automation, and early-warning precision to your fraud defense.

🔹 Start Free Trial

🔹 Book a Demo

🔹 Request Pricing

What Is the AI Fraud Detection Engine?

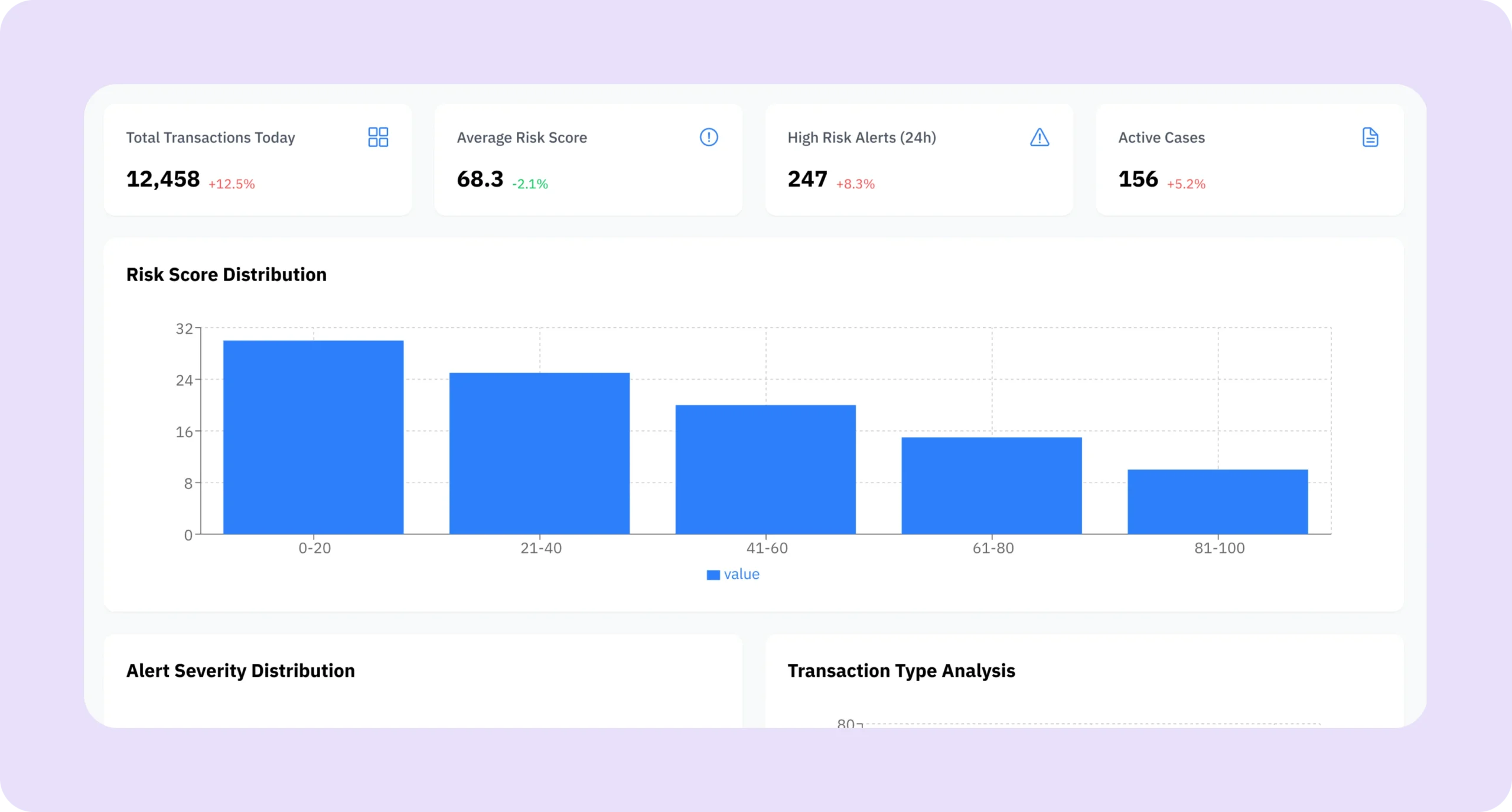

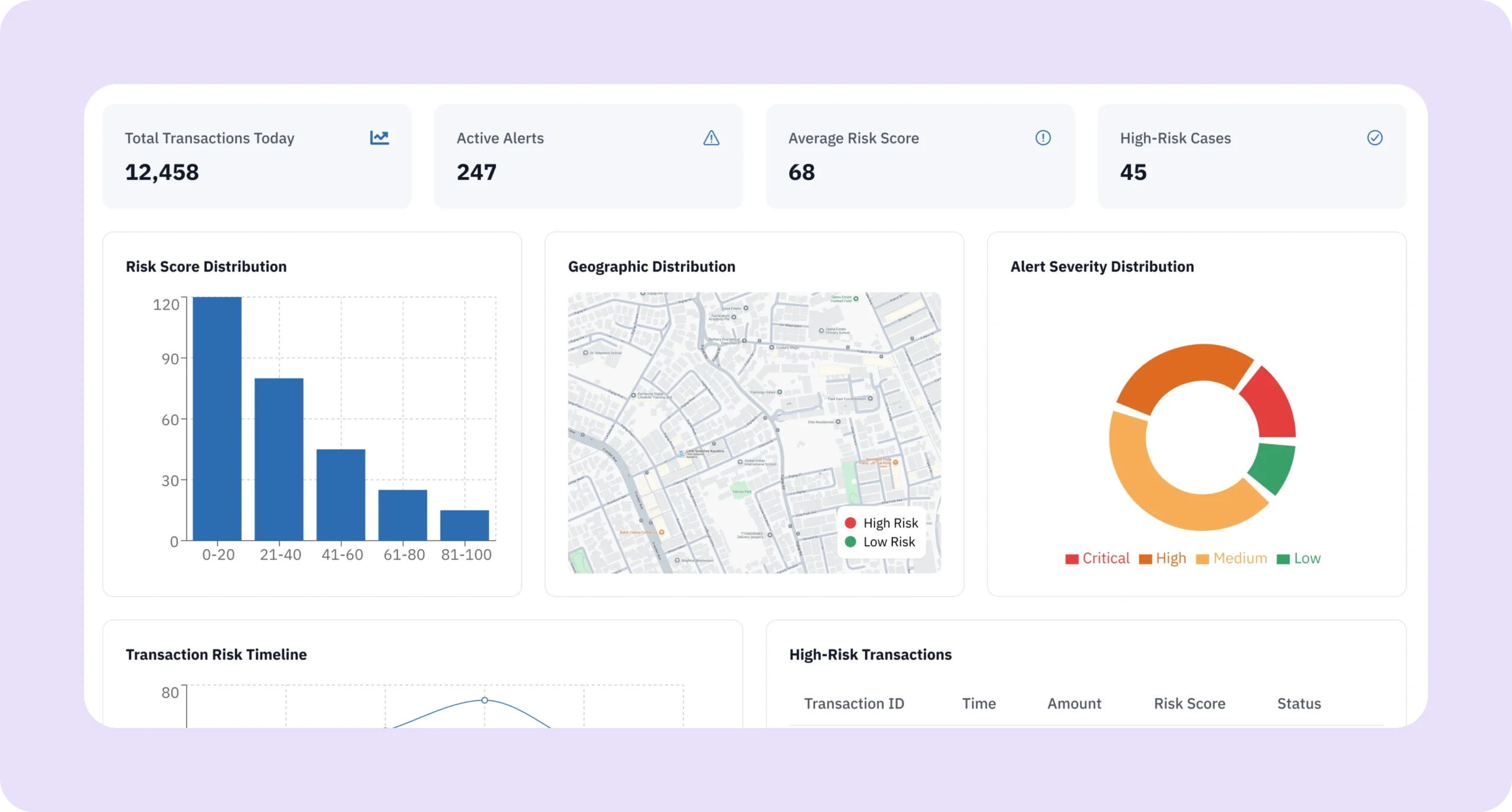

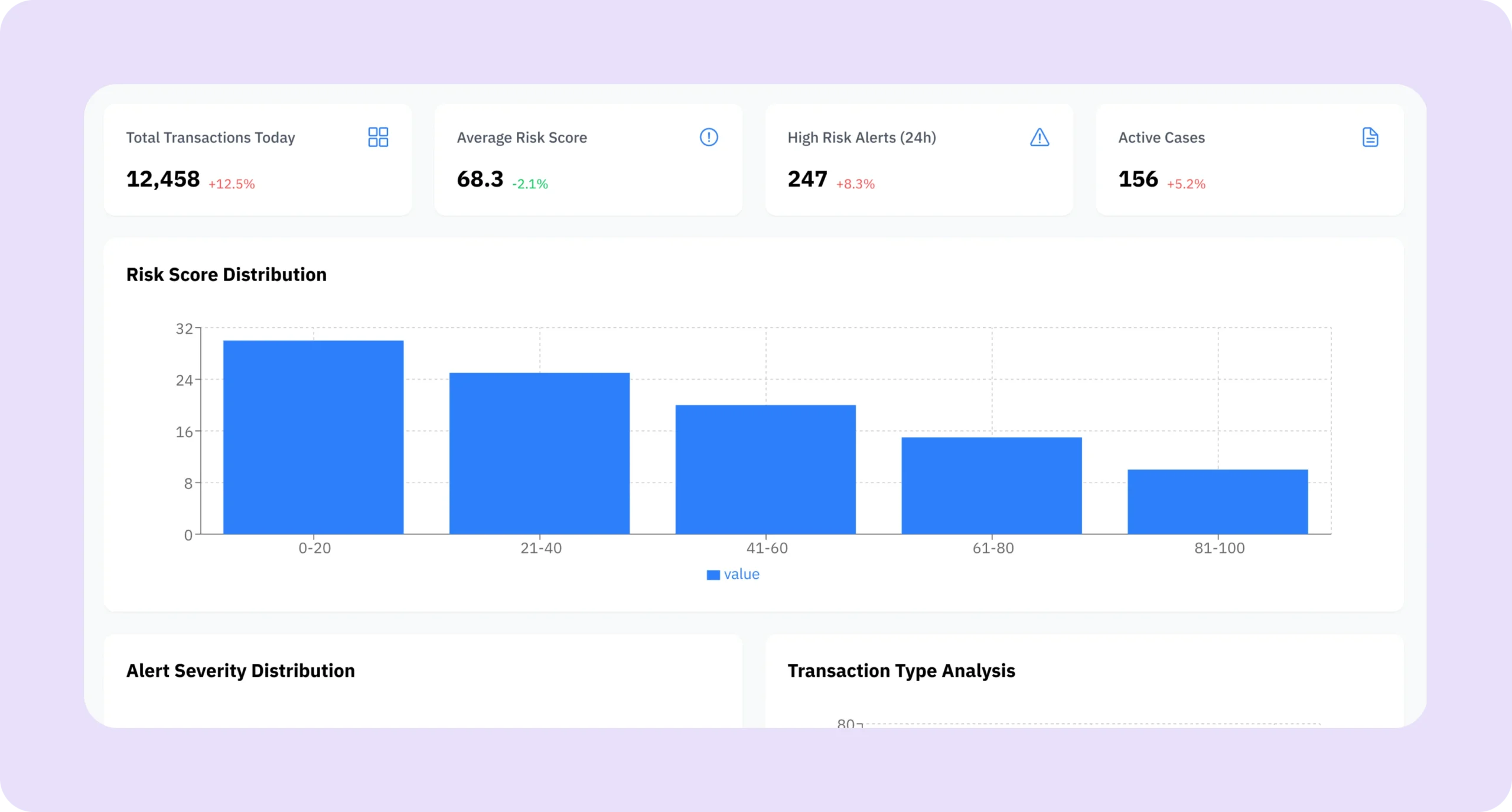

The AI Fraud Detection Engine is a customizable solution that uses machine learning, anomaly detection, and behavior analytics to identify patterns of fraud across your data streams. Built on the Kriatix AI low-code platform, it enables real-time detection, automated flagging, and proactive response mechanisms without needing a dedicated data science team.

Who Is It For?

| Role | How They Benefit |

|---|---|

| Fraud Analysts | Get real-time alerts and pattern-based insights into suspicious transactions |

| Compliance Teams | Stay audit-ready with automated fraud logging and case histories |

| Risk Managers | Set rules and thresholds to mitigate evolving fraud tactics |

| Finance Teams | Reduce chargebacks, false claims, and revenue leakage |

| CXOs & CTOs | Strengthen system integrity with AI-driven oversight |

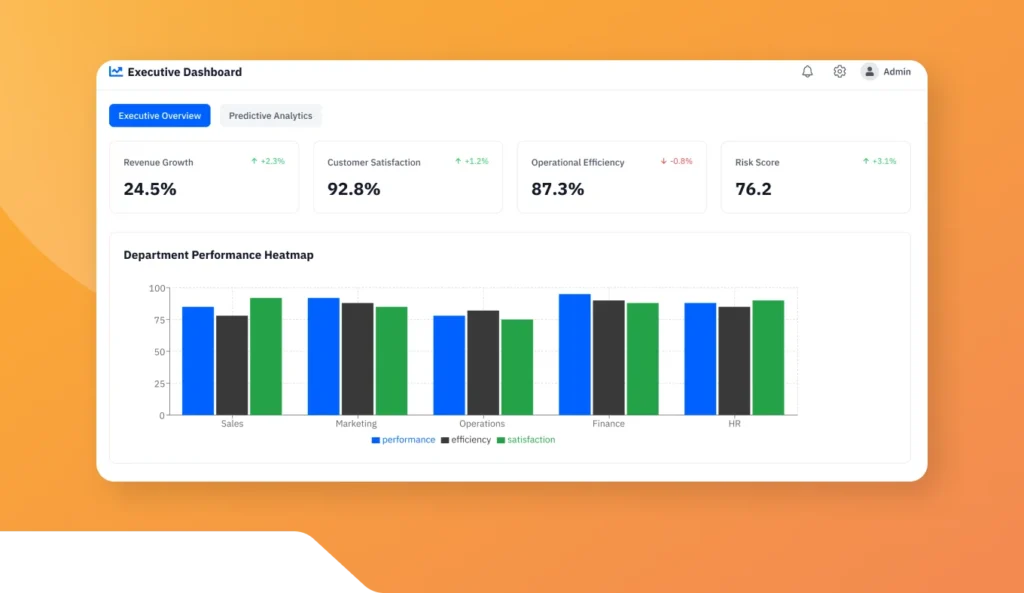

Key Features

- Real-time anomaly detection across transactions and behavior

- Pretrained ML models for fraud scenarios (payments, claims, logins, etc.)

- Custom rule engine to define fraud thresholds and escalation paths

- Risk scoring for each transaction or activity

- Automated alerts via email, Slack, or dashboards

- Case management dashboard with action history

- Data masking and role-based access for security compliance

Benefits

- Detect and stop fraud faster, with fewer false positives

- Reduce manual fraud investigations and operational overhead

- Customize models to your industry, region, and risk tolerance

- Improve trust among customers and regulators

- Seamlessly integrate with your core systems

- Access from anywhere via a secure web or mobile platform

How It Works

-

Connect Your Data

-

Choose a Detection Model

-

Define Risk Rules

-

Get Real-Time Alerts

-

Investigate & Act

Add-ons & Integrations

- Payment gateway connectors (Razorpay, Stripe, PayU, etc.)

- Banking & Core ERP system integrations

- Slack, MS Teams, WhatsApp & email alerting

- KYC & AML validation plugins

- Zapier, webhook, and API support

Deployment & Access

- Available via Web, Mobile, and Tablet

- SaaS (cloud-hosted) or On-Premise deployment

- Fully white-labeled for financial institutions and partners

What Our Partners Are Saying

Frequently Asked Questions

What types of fraud can this engine detect?

The engine can detect a wide range of fraud patterns, including payment fraud, identity theft, claims fraud (for insurance), login anomalies, account takeovers, and behavioral irregularities across digital systems.

How does the AI determine whether an activity is fraudulent?

It uses machine learning models trained on real-world fraud datasets along with your organization’s historical data. It identifies anomalies and assigns risk scores based on patterns that deviate from expected behavior.

Can we create our own custom rules and thresholds?

Yes. The platform includes a rule engine where you can define custom fraud triggers, escalation paths, and risk thresholds—tailored to your business model, region, and compliance standards.

Is the system capable of sending real-time alerts?

Absolutely. The engine can instantly notify your team via email, Slack, MS Teams, or in-app alerts whenever suspicious activity is detected- enabling swift response and case tracking.

Does it integrate with our existing payment gateways and CRMs?

Yes. The engine integrates easily with popular payment platforms (like Stripe, Razorpay, PayU), CRMs, core banking, insurance systems, and internal databases using APIs or connectors.

Ready to Automate Smarter with Kriatix?

Build next-gen, AI-powered apps and workflows—faster, smarter, and tailored to your industry.

Get Started